FCRA

The Foreign Contribution (regulation) Act, 2010 is an act of the Parliament of India, by the 42nd Act of 2010. It is a consolidating actwhose scope is to regulate the acceptance and utilisation of foreign contribution or foreign hospitality by certain individuals or associations or companies and to prohibit acceptance and utilisation of foreign contribution or foreign hospitality for any activities detrimental to the national interest and for matters connected therewith or incidental thereto.[1] It is designed to correct shortfalls in the predecessor act of 1976."

WHAT IS FOREIGN CONTRIBUTION?

Foreign Contribution means contribution and donation made by foreign source of

- Any article ( except an article given to a person as a gift for his personal use having market value in India not more than Rs. 25000/-)

- Any currency, whether Indian or foreign

- Any security including foreign security as defined in Foreign Exchange Management Act 1999

WHAT IS FOREIGN SOURCE?

What is foreign source?

- Government of any foreign country and any agency thereof

- Any international agency excluding the agencies specified by the Central Government

- A foreign company

- A corporation incorporated in a foreign country

- Multi- national corporation defined in FCRA, 2010

- A trade union in any foreign country

- A foreign trust or foundation

- A citizen of foreign country

- A society, club or other association formed or registered outside India

- A Company registered in India and more than half of share capital is held by

- Government of a foreign country

- Citizens of a foreign country

- Corporations incorporated in a foreign country

- Trusts, societies or other associations formed or registered in a foreign country

- Foreign company

WHAT IS FOREIGN SECURITY?

Foreign Security means any security in the form of shares, stocks, bonds, debentures or any other instrument denominated or expressed in foreign currency and securities expressed in foreign currency but where redemption or any other form of return such as interest or dividends is payable in Indian currency.

WHO CAN ACCEPT FOREIGN CONTRIBUTION?

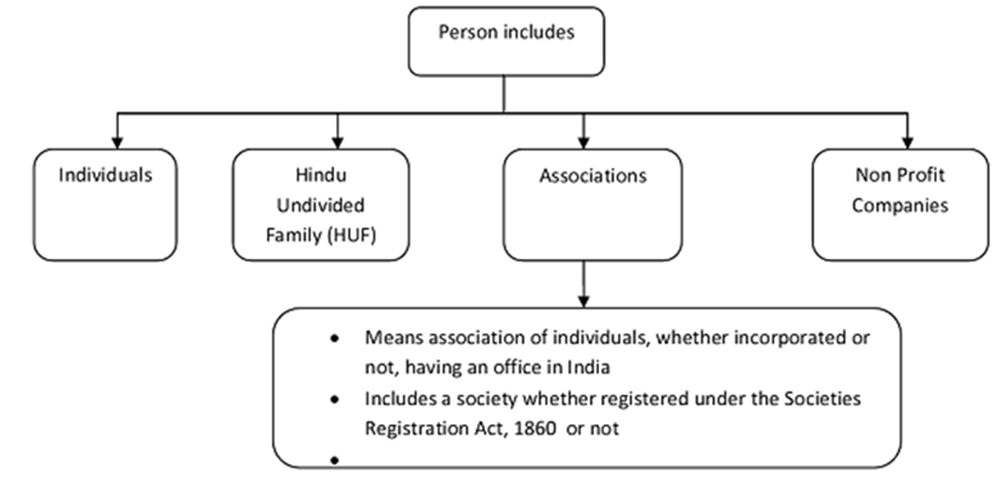

A person having a definite cultural, economic, educational, religious or social program can accept foreign contribution after getting registration or prior permission from the Central Government

WHO CANNOT ACCEPT FOREIGN CONTRIBUTION?

- Election candidate

- Member of any legislature (MP and MLAs)

- Political party or office bearer thereof

- Organization of a political nature

- Correspondent, columnist, cartoonist, editor, owner, printer or publishers of a registered Newspaper.

- Judge, government servant or employee of any corporation or any other body controlled on owned by the Government.

- Association or company engaged in the production or broadcast of audio news, audio visual news or current affairs programmes through any electronic mode

- Any other individuals or associations who have been specifically prohibited by the Central Government

HOW CAN FOREIGN CONTRIBUTION BE ACCEPTED?

Foreign contribution can be accepted only by taking the permission of the Central Government. Such permission can be taken in the following two ways:

- Registration (Regular)-Shall be valid for a period of 5 years and need to be renewed.

- Prior Permission (Adhoc)-Shall be granted for specific amount from a specific donor for specific purpose

WHAT ARE THE ELIGIBILITY CRITERIA FOR GRANT OF REGISTRATION?

The Association:

- Must be registered (under the Societies Registration Act, 1860or Indian Trusts Act 1882 or section 8 of Companies Act, 2013 etc)

- Normally be in existence for at least 3 years.

- Has undertaken reasonable activity in its field for the benefit of the society.

- Has spent at least Rs.10,00,000/- (Rs. ten lakh) over the last three years on its activities.

WHAT ARE THE ELIGIBILITY CRITERIA FOR GRANT OF PRIOR PERMISSION?

An Association, which has not completed 3 years of existence, is not eligible for grant of registration. Such organization may apply for grant of prior permission. For this, the Association:

- Must be registered (under the Societies Registration Act, 1860 or Indian Trusts Act 1882 or section 8 of Companies Act, 2013 etc.)

- Should submit a commitment letter from the donor indicating the amount of foreign contribution and the purpose

- Should submit copy of a reasonable project for the benefit of the society for which the foreign contribution is proposed to be utilized.

WHAT IS THE PROCESS FOR REGISTRATION/ PRIOR PERMISSION?

Following steps are to be followed:

- An application in prescribed form must be submitted online using FCRA online services.

- For this user Id and password is created.

- After creating user name and password, details are furnished as per the requirement and relevant documents are attached.

- After that application is finally submitted along with requisite documents and online fee is paid.

- Ministry of Home Affairs is supposed to grant registration/ prior permission within 90 days from the date of receipt of complete application.

FCRA FORMS AND RETURNS

FC-1

Intimation of receipt of foreign contribution by way of gift/as Articles/ Securities/ by candidate for Election.

FC-2

Application for seeking prior permission of the Central Government to accept foreign hospitality(FC-2)

FC-3A

Application for FCRA Registration

FC-3A

Application for FCRA Prior Permission

FC-3B

Application for FCRA Prior Permission

FC-3C

Application for Renewal of FCRA Registration

FC-4

Intimation - Annual Returns

FC-5

Application for seeking permission for transfer of foreign contribution to other un-registered persons.

FC-6A

Intimation - Change of name and/ or address within the State of the Association

FC-6B

Intimation - Change of nature, aims and objects and registration with local/relevant authorities in respect of the association

FC-6C

Intimation - Change of designated bank/ branch/ bank account number of designated FC receipt-cum-utilisation bank account

FC-6D

Intimation - Opening of additional FC-utilisation Bank Account for the purpose of utilisation of foreign contribution

FC-6E

Intimation - Change in original Key members of the association,

Updation of email Id in the FC- receipt cum utilisation and utilisation bank account details,

Updation of email Id in the FC- receipt cum

utilisation and utilisation bank account details,

Filling of Annual returns of assets and liablities under Lokpal and Lokayukts Act, 2013 by individual of Association.